Congress is all kinds of fucking up these days. We barely dodged a government shutdown that wouldn't have done anything good to the economy, and now the Democrats are starting their negotiations with the Republicans by offering up a conservative-leaning plan to begin with. (Protip: You're supposed to start way more to the left than you think you can get and negotiate toward the middle, not start in their neighborhood and get negotiated even further to the right.) And of course, no one's talking about raising taxes.

I'm not saying that various adjustments and cuts shouldn't happen. I'm in favor of raising the age limit for Medicare and Social Security--seems only fair, when people are living longer--and you all know I think we ought to gut the Pentagon's budget (as it, by at least three-quarters, not by a few tens of billions here or there). And programs like Medicare, Medicaid and Social Security could no doubt be streamlined and adjusted for greater efficiency--nothing's perfect, after all.

(A quick aside--I don't mean "streamlined" or "adjusted" the way the Republicans do, e.g., destroyed. Medicare, Medicaid and Social Security are vital to the health of this society and its most vulnerable members, and anyone who gives a damn about the elderly, the poor and the otherwise disadvantaged is a moron or morally bankrupt if they are not horrified by Republican plans to literally end some of these programs for future generations.)

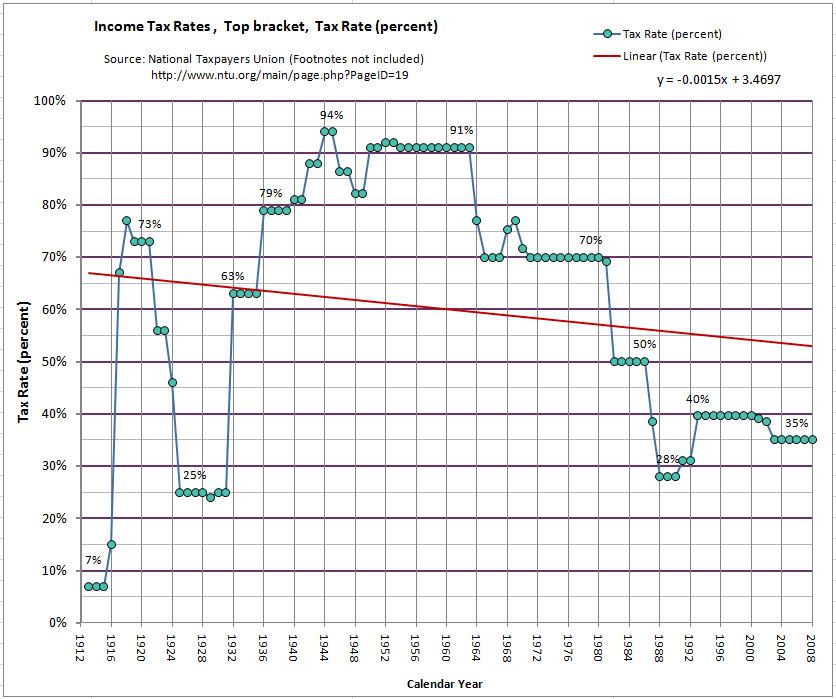

But--we must raise taxes. And not just for the rich--I advocate raising them across the board--yeah, for our shrinking middle class, too--at least back to pre-Bush levels. But we ought to tax the rich a great deal more. Like, 80-90% of their income. Opponents of such tax policy say that this will stifle economic growth, etc. Such people are either lying to you for reasons of ideology or personal greed, or they are idiots. There is no historical evidence to back them up. Peep this graph from the National Taxpayers Union (which is, I should mention, dedicated to lowering taxes):

You will notice that for much of the twentieth century, the wealthiest Americans paid what is known in technical terms as a shitful of taxes--sometimes, in excess of 90%. From the postwar period on, they paid at least 70% until Reagan showed up. Now, any American historian can tell you that the period from 1945 to the mid to late-1960s was the most economically prosperous era in American history. That's the period when the United States catapulted from a respectable major power to the global superpower it remained until the War on Terror revealed its combination of incompetence and impotence.

Taxing the rich is good for the economy. Yes, it's true, higher taxes leave the wealthy with less money to invest. They thing is, they don't always invest in things that grow the economy. We've all heard about speculation and the disastrous effect it has on the prices of necessary commodities like food and oil--who ever could be doing that speculative investment? And the wealthy don't build infrastructure or roads. Honestly, private individuals don't build much at all anymore--massive corporations open new stores and factories, not individual actors.

Finally, there's the moral side of the equation. The wealthy receive the most benefits from our society. They have access to opportunities many of us will never enjoy. And it's not an accident of the system that wealth is concentrated in the hands of a relative few--that's how capitalism is supposed to work. That's how it's designed. Therefore, it doesn't seem at all unfair that the wealthy be expected to pay more to support a system that works to their benefit in the first place.

And, in the final assessment, 10% of $10 million is still $1 million. 30% of $10 million is still $3 million. And this is a nation with hundreds of billionaires. By contrast, the median household income in this country is $44,389, with more than 50% of households earning less than $50,000.

How much fucking money do you really need?

(None of the above is particularly original to me, aside from the profanity. You can find similar arguments all over the interwebs. But I figured one more voice saying the same shit wouldn't hurt, right? Plus, it's not like anyone

Fuck you--I matter and I'm listening! ;) CLAM STRIPS

ReplyDeleteLike most people, I'm not loving the idea of raising our taxes because I feel like we pay a TON already...but you're probably right.

ReplyDeleteWell said brother, well said!

ReplyDelete